The Of Personal Loans copyright

The Of Personal Loans copyright

Blog Article

Personal Loans copyright Fundamentals Explained

Table of ContentsLittle Known Questions About Personal Loans copyright.The Main Principles Of Personal Loans copyright The Best Guide To Personal Loans copyrightPersonal Loans copyright for DummiesNot known Facts About Personal Loans copyrightThe Facts About Personal Loans copyright Uncovered7 Easy Facts About Personal Loans copyright Explained

There might be constraints based on your credit report or background. Make sure the loan provider supplies fundings for a minimum of as much money as you require, and aim to see if there's a minimum funding quantity too. However, know that you may not get approved for as huge of a finance as you want.Variable-rate fundings often tend to begin with a reduced rate of interest, however the rate (and your payments) could rise in the future. If you want assurance, a fixed-rate loan may be best. Look for online reviews and comparisons of lenders to find out concerning other customers' experiences and see which loan providers could be a good fit based upon your credit reliability.

This can normally be done over the phone, or in-person, or online. Depending on the credit rating version the lending institution utilizes, multiple tough queries that happen within a 14-day (sometimes approximately a 45-day) window might just count as one difficult inquiry for credit history functions. Furthermore, the racking up version might disregard questions from the previous thirty day.

The Greatest Guide To Personal Loans copyright

If you obtain approved for a finance, reviewed the small print. Inspect the APR and any kind of other charges and fines - Personal Loans copyright. You ought to have a full understanding of the terms prior to consenting to them. Once you accept a financing offer, numerous lending institutions can transfer the money straight to your monitoring account.

Individual finances can be made complex, and discovering one with a great APR that fits you and your budget takes time. Before taking out an individual financing, make certain that you will have the ability to make the monthly payments on time. Personal fundings are a quick way to obtain money from a bank and other monetary institutionsbut you have to pay the money back (plus passion) over time.

What Does Personal Loans copyright Do?

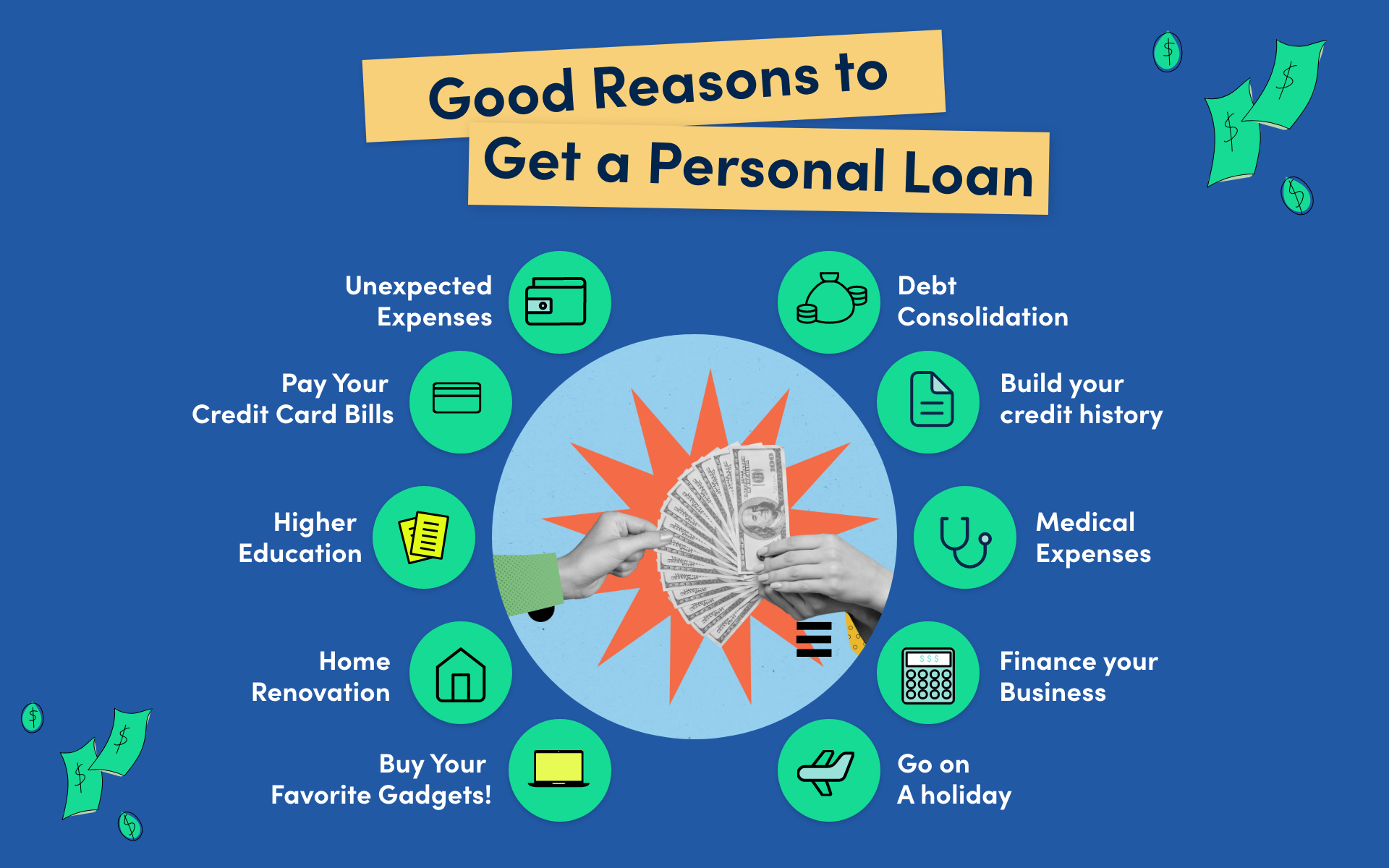

Allow's study what an individual finance really is (and what it's not), the factors people utilize them, and how you can cover those insane emergency expenditures without handling the worry of financial obligation. An individual car loan is a round figure of cash you can borrow for. well, nearly anything.

, however that's practically not a personal funding. Personal Loans copyright. Individual financings are made through an actual economic institutionlike a bank, credit union or on-line lending institution.

Allow's have a look at each so you can recognize specifically just how they workand why you do not require one. Ever before. A lot of individual financings are unsafe, which implies there's no collateral (something to back the finance, like a car or house). Unprotected finances normally have higher rates of interest and need a far better credit report because there's no physical item the lender can eliminate if you do not pay up.

A Biased View of Personal Loans copyright

No matter exactly how excellent your credit rating is, you'll still have to pay passion on a lot of personal finances. Safe individual car loans, on the other hand, have some kind of security to "secure" the finance, like a watercraft, jewelry or RVjust to name a few (Personal Loans copyright).

You might additionally take out a secured personal finance utilizing your vehicle as collateral. That's a hazardous action! You don't want your primary setting of transportation to and from work obtaining repo'ed due to the fact that you're still paying for in 2014's cooking area remodel. Trust us, there's absolutely nothing safe concerning guaranteed finances.

Getting The Personal Loans copyright To Work

Called adjustable-rate, variable-rate financings have passion prices that can change. You could be attracted in by the stealthily low price and inform yourself you'll pay off the loan promptly, yet that number can balloonand quick. It's simpler than you think to get stuck to a higher rate of interest rate and monthly payments you can not manage.

And you're the fish his response hanging on a line. An installment financing is a personal car loan you repay in dealt with installments over time (generally when a month) until it's paid completely. And don't miss this: You need to pay back the initial financing quantity before you can obtain anything else.

Do not be mistaken: This isn't the exact same as a debt card. With personal lines of credit, you're paying passion on the loaneven if you pay on time.

This obtains us riled up. Why? Because these businesses exploit people who can't pay their costs. And that's just wrong. Technically, these are temporary finances that provide you your income ahead of time. That may seem enthusiastic when you remain in a monetary wreckage and require some cash to cover your bills.

Examine This Report on Personal Loans copyright

Why? Since things get real messy actual quick when you miss a payment. Those creditors will certainly follow your pleasant grandma who guaranteed the car loan for you. Oh, and you should never ever guarantee a finance for any individual else either! Not only can you obtain stuck with a loan that was never ever indicated to be yours in the initial area, but it'll ruin the partnership before you can say "compensate." Count on us, you do not intend to get on either side of this sticky circumstance.

All you're truly doing is making use of new financial obligation to pay off old debt (and prolonging your lending term). That simply suggests you'll be paying a lot more over time. Business recognize that toowhich is exactly why a lot of of them use you debt consolidation car loans. A reduced rate of interest doesn't obtain you out of debtyou do.

You just obtain an excellent debt score by borrowing moneya great deal of cash. Around below, we call it the "I love financial obligation score." Why? Because you handle a lots of financial debt and visit the site threat, just for the "opportunity" of entering into a lot more financial obligation. The system is set up! Don't worry, there's good news: You do not need to play.

Some Known Incorrect Statements About Personal Loans copyright

And it begins with not obtaining anymore money. ever before. This is a good general rule for any kind of monetary purchase. Whether you're thinking about obtaining a personal finance to cover that kitchen area remodel or your overwhelming charge card bills. do not. Taking out financial debt to pay for points isn't the way to go.

And if you're taking into consideration a personal funding to cover an emergency situation, we get it. Obtaining cash to pay for an emergency only intensifies the stress and anxiety and challenge of the situation.

Report this page